|

By Simi Kedia and Thomas Philippon ILLUSTRATION BY GORDON STUDER Large-scale earnings fraud doesn't just leave investors poorer – it

leads to slower employment growth across the whole economy.  raudulent accounting by management is obviously costly for shareholders. When earnings are restated, stocks typically fall sharply. Take the dramatic case of Enron. On November 8, 2001, the formerly high-flying energy company announced it would restate earnings for the period 1997 through 2001 and record a $1.2 billion reduction to shareholders equity. In the weeks between October 16, 2001, and November 28, 2001, Enron’s stock plummeted from more than $30 to less than $1 a share. The period of misreporting was characterized by substantial stock sales by Enron insiders, who profited at the expense of other shareholders. raudulent accounting by management is obviously costly for shareholders. When earnings are restated, stocks typically fall sharply. Take the dramatic case of Enron. On November 8, 2001, the formerly high-flying energy company announced it would restate earnings for the period 1997 through 2001 and record a $1.2 billion reduction to shareholders equity. In the weeks between October 16, 2001, and November 28, 2001, Enron’s stock plummeted from more than $30 to less than $1 a share. The period of misreporting was characterized by substantial stock sales by Enron insiders, who profited at the expense of other shareholders.

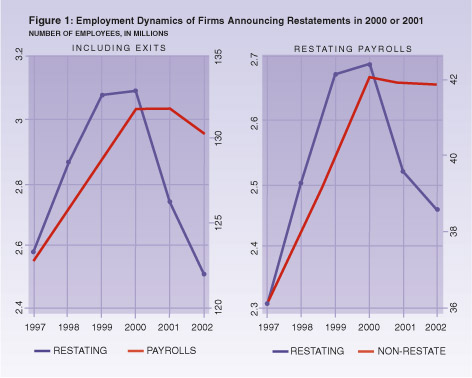

During this same period, Enron grew faster than any other firm in its industry. The book value of Enron's assets nearly tripled, from $23.5 billion in 1997 to $65.5 billion in 2000. At its peak, Enron employed more than 20,000 employees worldwide. But after its restatement, Enron shrank rapidly. Today, about 500 employees remain, and Enron’s creditors expect to receive about one-fifth of the estimated $63 billion they are owed. Enron is a typical – if somewhat extreme – example of fraudulent accounting in periods of high financial valuations. Much of the research on earnings management has focused on how and why it happens. But academics have been hesitant to explore the way earnings management affects the allocation of resources. For example, it stands to reason that fraudulent accounting would distort labor markets. The general assumption is that in the case of earnings manipulation, inefficiencies arise automatically when the hiring and investment decisions are endogenous – and observable – because the need to mimic the good types distorts all the observable actions of the bad types. Bad managers who want to hide their poor quality must not only manage their earnings, but also hire and invest like good managers. So firms managing earnings hire and invest like successful firms. As a result, fraudulent firms end up larger than might be predicted given the fundamentals of their business. Hence, one would expect to see these firms shrink and shed jobs after they are exposed. Restatement Trends We tested this hypothesis by constructing an econometric model and applying it to a set of data on firms that restated their earnings. The General Accounting Office (GAO) in 2002 identified 919 financial restatements by 845 public companies from January 1, 1997, to June 30, 2002, that involved accounting irregularities resulting in material misstatements of financial results. Such restatements occur when a company, either voluntarily or prompted by its auditors or regulators, revises previously reported public financial information. Of the companies, 645 were publicly traded. The number of identified restatements rose from 92 in 1997 to 225 in 2001. “The proportion of listed companies on NYSE, Amex, and NASDAQ identified as restating their financial reports tripled from 0.89 percent in 1997 to 2.5 percent in 2001,” the GAO concluded. “From January 1997 through June 2002, about 10 percent of all listed companies announced at least one restatement.” Moreover, later restatements involved larger firms: The average market capitalization of restating companies quadrupled between 1997 and 2002, from $500 million to $4 billion, while the average size of listed companies increased only about 60 percent over the same period.  he GAO also reported the reasons for the restatements. Errors in revenue recognitions accounted for roughly 40 percent of the cases while those due to improper cost accounting explained 16 percent. Issues with loans, such as write-offs, reserves, and bad loans, accounted for 14 percent of the cases. Issues with assets and inventories, such as goodwill, write downs, and valuation, account for another 9 percent of restatements. The remaining 20 percent of cases are linked to research and development, mergers and acquisitions, securities, reclassifications of debt payments, and related-party transactions. It is useful to keep in mind that only 16 percent of the restatements can be formally attributed to actions by external parties, such as the SEC or independent auditors. Further, many firms did not mention in their reports the real reason for their restatements unless they were somehow forced to do so. he GAO also reported the reasons for the restatements. Errors in revenue recognitions accounted for roughly 40 percent of the cases while those due to improper cost accounting explained 16 percent. Issues with loans, such as write-offs, reserves, and bad loans, accounted for 14 percent of the cases. Issues with assets and inventories, such as goodwill, write downs, and valuation, account for another 9 percent of restatements. The remaining 20 percent of cases are linked to research and development, mergers and acquisitions, securities, reclassifications of debt payments, and related-party transactions. It is useful to keep in mind that only 16 percent of the restatements can be formally attributed to actions by external parties, such as the SEC or independent auditors. Further, many firms did not mention in their reports the real reason for their restatements unless they were somehow forced to do so. Out of the 645 publicly traded companies, 560 firms were covered by COMPUSTAT. For 539 of those firms, we were able to obtain the beginning and end dates of the restated period, in addition to the date on which the restatement was announced. We also collected data on the size of the restatement – the average annual impact of the restatement on net income – for 396 firms. The average ratio of restated earnings over lagged sales was -6 percent, and 80 percent of the restatements involved negative revisions to reported net income.  ext, we examined the growth rate in the number of employees, in the rate of property plant and equipment (PP&E), and the ratio of capital expenditures to property plant and equipment for restating and non-restating COMPUSTAT firms over the period 1991 to 2003. According to these three measures, restating firms grew slightly faster than non-restating firms over the whole sample, but the differences were very small relative to the standard deviations of these variables. Unconditional dynamics of restating and non-restating firms, such as market values and sales and total factor productivity (TFP) growth were also quite similar for restating and non-restating firms. ext, we examined the growth rate in the number of employees, in the rate of property plant and equipment (PP&E), and the ratio of capital expenditures to property plant and equipment for restating and non-restating COMPUSTAT firms over the period 1991 to 2003. According to these three measures, restating firms grew slightly faster than non-restating firms over the whole sample, but the differences were very small relative to the standard deviations of these variables. Unconditional dynamics of restating and non-restating firms, such as market values and sales and total factor productivity (TFP) growth were also quite similar for restating and non-restating firms. | “The growth of employment in fraudulent firms was 3.7 percent higher during the fraudulent period. …The growth of employment was significantly lower after the restatement.” | To compare the dynamics of hiring and investment for restating firms around the restated period, we created a control group of non-restating firms that are matched in age, industry, and initial size. And for every restating firm, we selected non-restating firms that operate in the same industry, and that are in the same initial book asset quintile. Next, we plotted the mean adjusted growth rates for four key variables: total market value, number of employees, PP&E, and TFP. We found that the market value of restating firms grew at a faster rate (5.2 percent higher) than that of the control group before the restated period, at the same rate during the restated period, and more slowly (4 percent lower) afterwards. A similar picture emerged with respect to growth in PP&E and the number of employees. The growth of employment in fraudulent firms was 3.7 percent higher during the fraudulent period. And as predicted by the model, the growth of employment was significantly lower after the restatement. A similar dynamic is seen with investment activity. The growth rate of investment – i.e. PP&E – was about 5 percent higher during the restated period and 6 percent lower after the restated period. It appears that restating firms were growing rapidly in the years prior to the restated period, and that these firms most likely misreported in order to continue portraying themselves as high-growth firms. Interestingly, the growth rates of TFP and labor productivity were not significantly different across firms and over time. As the period after the restatement is not associated with lower productivity, it is unlikely that restatements were the result of negative TFP shocks. Moreover, as the sales in the restated period were inflated by fraudulent accounting for a large fraction of firms, the true productivity probably increased after the restatement. Next we turned to the sub-sample of firms for which we were able to collect information on the size of the restatement. When we ran the numbers, we found that larger restatements were associated with larger drops in employment and investment. Aggregate Growth  What were the aggregate effects of earnings manipulation? A clear picture of the raw data can be obtained by looking at the dynamics of the 111 firms that announced a restatement in 2000, and the 120 firms that did so in 2001. The number of people employed in these 231 restating firms over the period 1997 to 2002 is displayed in Figure 1. The left panel compares the 231 restating firms to aggregate non-farm payrolls obtained from the Bureau of Labor Statistics (BLS). Employment in restating firms rose by 500,000 (25 percent) between 1997 and 1999, and fell by 600,000 (24 percent) between 2000 and 2002. Over the same periods, total non-farm payrolls went up by 6.7 percent and then down by 1.5 percent. The relative increases and decreases in employment for restating firms are clearly much larger than for the economy as a whole. What were the aggregate effects of earnings manipulation? A clear picture of the raw data can be obtained by looking at the dynamics of the 111 firms that announced a restatement in 2000, and the 120 firms that did so in 2001. The number of people employed in these 231 restating firms over the period 1997 to 2002 is displayed in Figure 1. The left panel compares the 231 restating firms to aggregate non-farm payrolls obtained from the Bureau of Labor Statistics (BLS). Employment in restating firms rose by 500,000 (25 percent) between 1997 and 1999, and fell by 600,000 (24 percent) between 2000 and 2002. Over the same periods, total non-farm payrolls went up by 6.7 percent and then down by 1.5 percent. The relative increases and decreases in employment for restating firms are clearly much larger than for the economy as a whole.  potential concern in this analysis is that some firms drop out of the sample after the announcement of the restatement, due to delisting or bankruptcy. In the left panel, we implicitly assigned zero employees to firms that drop out. For instance, complete data for Enron is available only until 2000. To the extent that some firms drop out of the sample, but, unlike Enron, continue operating, the left panel may overestimate the true dynamics. So we constructed a constant sample of firms for which we have complete data over this period. This constant sample comprises 74 firms that restated in 2000, and 96 firms that restated in 2001. The right panel of Figure 1 compares the employment in these restating firms to a constant sample of non-restating firms in COMPUSTAT. As seen, restating firms grew more rapidly than non-restating firms from 1997 to 1999, and declined much faster afterwards. potential concern in this analysis is that some firms drop out of the sample after the announcement of the restatement, due to delisting or bankruptcy. In the left panel, we implicitly assigned zero employees to firms that drop out. For instance, complete data for Enron is available only until 2000. To the extent that some firms drop out of the sample, but, unlike Enron, continue operating, the left panel may overestimate the true dynamics. So we constructed a constant sample of firms for which we have complete data over this period. This constant sample comprises 74 firms that restated in 2000, and 96 firms that restated in 2001. The right panel of Figure 1 compares the employment in these restating firms to a constant sample of non-restating firms in COMPUSTAT. As seen, restating firms grew more rapidly than non-restating firms from 1997 to 1999, and declined much faster afterwards. Clearly, the truth lies somewhere in between the left panel and the right panel. If most restating firms are like Enron, then the left panel is the better approximation. If most restating firms continue operating with a reduced, but still significant, number of employees, then the right panel is more appropriate. Larger Impact The dynamics of restating firms, which make them grow faster than comparable firms in the restated period and slower afterwards, are also likely to impact other non-restating firms in their industry. Some non-restating firms surely engaged in earnings management, but probably to a lesser extent than firms that eventually had to restate. Moreover, investors may draw negative inferences about all firms that belong to an industry where many accounting frauds have been revealed, even if most of the firms were actually honest. This suggests that the announcement of a restatement could have negative implications for other non-restating firms in the industry. We investigated the impact of restatements on non-restating firms by creating a panel of industries using only the non-restating firms. We found that non-restating firms grew more slowly when they belonged to an industry that had a lot of announced restatements in the preceding years. Interestingly, sales per employee and TFP grew significantly faster following a wave of restatements. In other words, fraudulent industries were characterized by high labor productivity growth together with negative employment and investment growth, even for firms that did not have to restate their earnings. Earnings manipulation isn’t just bad news for the shareholders of the companies directly involved. It can impact aggregate dynamics through two opposing channels. On the one hand, the inefficient allocation of resources among firms, created by earnings management, tends to reduce aggregate activity. On the other hand, greater hiring and investment by misreporting firms tend to increase aggregate activity and then lead to depressed activity after the wrongdoing is revealed. In other words, imperfect governance amplifies business cycle dynamics. The period after the brief 2001 recession was characterized by frustratingly low job growth, as payrolls did not bounce back as they typically do when the economy starts to expand. Many economists and analysts were mystified by the strange dynamics in the labor market in the post-bubble era. Our study, however, suggests that it’s not unnatural for periods with high levels of earnings restatements to be followed by periods of jobless growth and low investment. Sami Kidia (Phd ’97) is assistant professor of finance and economics at Rutgers University and Thomas Philippon is assistant professor of finance at NYU Stern. |

![]()