|

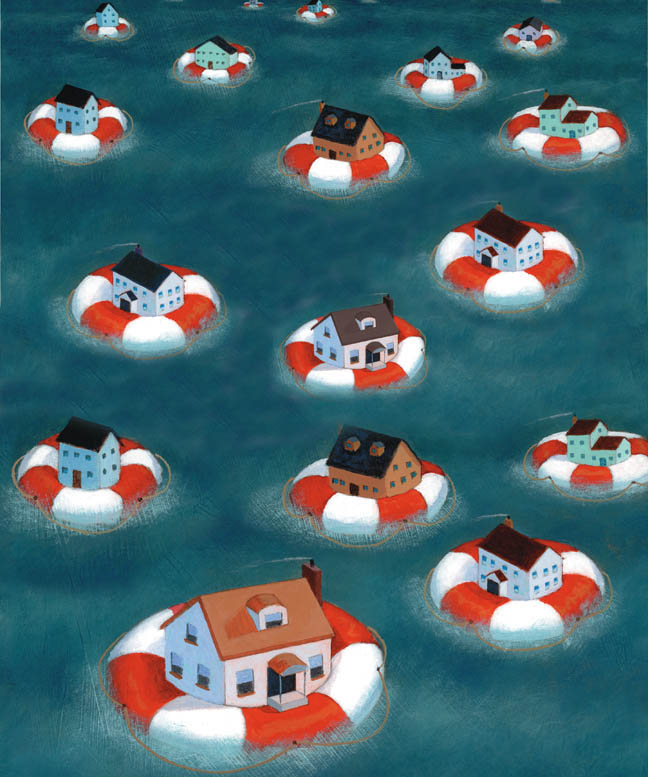

ILLUSTRATION BY STEVE DININNO

By Yuliya Demyanyk and Otto Van Hemert

he fallout from the subprime mortgage crisis has been roiling the US economy for more than a year and will certainly continue to have an effect for some time. Many observers wonder how a situation of such magnitude could have developed to such a disastrous point under the radar, so to speak, of our most sophisticated financial institutions and regulatory officials. he fallout from the subprime mortgage crisis has been roiling the US economy for more than a year and will certainly continue to have an effect for some time. Many observers wonder how a situation of such magnitude could have developed to such a disastrous point under the radar, so to speak, of our most sophisticated financial institutions and regulatory officials.

As is by now well known, the subprime market grew dramatically starting in 2001. Based on our database, which covered roughly half of the subprime mortgage market, the number of new loans in each year more than quadrupled, and the average loan size almost doubled over the sample period. The total dollar amount of loans originated in 2001 was $94 billion; astoundingly, in 2006, it was $685 billion.

We took a close look at the history of mortgage loans between 2001 and 2006 to see if there was any pattern evident that could have led people to foresee, and thus forestall, the crisis that occurred in 2007. Because of the large amount of detailed data, we did a number of regressions of differing complexity before the answers began to emerge. For one, we analyzed the quality of subprime loans by adjusting their performance for differences in borrower characteristics, loan characteristics, and economic circumstances. The results showed that even by the end of 2005, a dramatic deterioration of loan quality could have been detected – had it only been observed.

Indeed, problems in the subprime mortgage market were imminent long before the actual crisis surfaced, but apparently went unnoticed. Our theory is that steep appreciation in the price of houses over the period since 2001 – the boom years – actually masked the true riskiness of the subprime mortgage loans, as distressed homeowners were able to refinance their way out of trouble until the chickens came home to roost and the cycle went bust.

Disquieting Patterns

We derived our data from a loan-level database containing information on about half of all US subprime mortgages originated between 2001 and 2006. What exactly constitutes a subprime loan is a matter of some debate. For example, the term subprime can refer to certain characteristics of a borrower, such as a poor credit rating or a previous history of foreclosure; or a lender, who may originate high-cost loans or originate more refinances than purchase-money loans, for example; or a security, of which a subprime loan can become a part; or a borrower with a decent credit history who is risky in other ways, such as providing no documentation verifying income or paying no money down. The common factor across these definitions is the high risk of default. For purposes of our investigation, we focused on first-lien loans over the 2001 to 2007 period.

ur findings on delinquent loans revealed noteworthy information. We defined a loan to be delinquent if payments on the loan were 60 or more days late or the loan was in foreclosure. For the subprime market as a whole, we found that the vintage 2006 loans stood out in terms of high delinquencies and foreclosures. Further, the bad performance of that vintage was not confined to a particular segment of the subprime market, but rather reflected a market-wide phenomenon. ur findings on delinquent loans revealed noteworthy information. We defined a loan to be delinquent if payments on the loan were 60 or more days late or the loan was in foreclosure. For the subprime market as a whole, we found that the vintage 2006 loans stood out in terms of high delinquencies and foreclosures. Further, the bad performance of that vintage was not confined to a particular segment of the subprime market, but rather reflected a market-wide phenomenon.

“The combination of a large increase in credit availability, easier financing, lowering price, and deteriorating loan performance resembles a classic lending boom-bust scenario in which unsustainable growth lead to the collapse of the market.” |

It is important to note that, at first sight, our finding that the crisis also worsened the performance of fixed-rate mortgages (FRMs) seems at odds with remarks in 2007 by Federal Reserve Chairman Ben Bernanke, who said that serious delinquencies in that sector had been “fairly stable at about 5.5 percent.” The discrepancy occurred because we compared FRMs of the same age that originated in different years. If just the outstanding mortgages altogether were analyzed, the picture more closely resembles Bernanke’s observation. We plotted exactly this for both FRMs and hybrid mortgages and found that the delinquency rate of outstanding FRMs did remain fairly constant as of 2005, as the Fed chairman observed. But the result is affected by an aging of the FRM pool caused by a decrease in the popularity of FRMs. FRMs that originated in 2006 performed unusually badly.

Among the interesting results our analysis generated was the impact of the combined loan-to-value ratio (CLTV) on mortgage rates over time. Considering all first-lien loans, about 30 percent have a CLTV smaller than 80 percent; about 20 percent have a CLTV of exactly 80 percent; and about 50 percent have a CLTV greater than 80 percent. The average CLTV increased slightly from 80 percent in 2001 to 84 percent five years later. Also, the distribution shifted slightly over time: in 2001 the percentage of loans in these three CLTV categories was 35 percent, 20 percent, and 45 percent, respectively; in 2006, it was 28 percent, 14 percent, and 58 percent, respectively. Our analysis showed that high CLTV ratios have been increasingly associated with higher delinquency rates.

Common sense says that the burden of all the debt together may be the factor that triggers financial problems, which motivated us to use the CLTV as a determinant of delinquency and foreclosure. However, the first-lien LTV is an even more important determinant of the mortgage rate, possibly because the loss-given-default on the first-lien loan is more related to the first-lien LTV than the CLTV. We wondered whether lenders were aware of high LTV ratios being increasingly associated with riskier borrowers. To this end, we tested, via a series of regressions, whether the sensitivity of the lender’s interest rate to the first-lien LTV ratio changed over time. We found that lenders were to some extent aware of the association between high LTV ratios and risky borrowers.

Bad Behavior

In another exercise, we explored the behavior of the subprime-prime rate spread. In general, the mortgage rate on subprime mortgages is higher than on prime mortgages in order to compensate the lender for the additional default risk associated with subprime mortgages. To explore the rate spread pattern, we focused on FRMs, not hybrid mortgages, because the price of hybrids is determined by both the initial teaser rate and the margin over the index rate, which complicates the comparison of subprime and prime rates. We used data on subprime rates from the LoanPerformance database, and for the prime rate, we used the contract rate on FRMs reported by the Federal Housing Finance Board in its Monthly Interest Rate Survey. We found that the subprime-prime rate spread declined over time, both with and without adjustment for changes in loan and borrower characteristics. At the same time, the riskiness of loans has increased, implying that on a per-unit basis, the subprime-prime spread declined even more.

With all this interesting data in hand, our overriding question was as follows: Based on information available at the end of 2005, was the dramatic deterioration of loan quality already apparent? To answer this, we had to recalculate existing regressions, making use of data between 2001 and 2005, not 2006. The resulting age pattern in the corrected delinquency rate, after adjusting for loan and borrower characteristics and economic circumstances, has been rising steadily since 2001, and the marked deterioration of the loan quality was already apparent by the end of 2005.

Some have argued that the explosive growth in the subprime mortgage market was largely fueled by the development of mortgage-backed securities (MBS) into so-called private-label MBS, which are loans securitized by a party different from the Government Sponsored Enterprises (GSEs) and do not carry any kind of guarantee. In contrast to buyers of GSE-issued MBS, buyers of the private-label MBS bear the default risk on the mortgage loan. Searching for a higher yield, the argument goes, investors kept increasing their demand for the private-label MBS, which led to sharp increases in the subprime share of the mortgage market – from around 8 percent in 2001 to 20 percent in 2006 – and in the securitized share of the subprime mortgage market – from 54 percent in 2001 to 75 percent in 2006.

Hindsight is 20/20

We showed that during the dramatic increase of the subprime (securitized) mortgage market, the quality of the market also dramatically deteriorated, vis à vis the performance of the loans adjusted for differences in borrower characteristics, loan characteristics, and subsequent house appreciation. The degeneration of the loan quality has been unvarying and steady, but not equally so among different types of borrowers. Over time, high-LTV borrowers became increasingly risky compared to low-LTV borrowers. Securitizers seem to have been aware of this particular pattern in the relative riskiness of borrowers: we demonstrated that over time they made the mortgage interest rate more sensitive to the LTV ratio of borrowers. Specifically, in 2001, a borrower was hardly charged a higher interest rate for the higher LTV ratio. In contrast, in 2006, a borrower with a one-standard deviation above-average LTV ratio was charged an interest rate higher by 30 basis points.

In principle, the subprime-prime mortgage rate spread, or subprime markup, should account for the default risk on subprime loans. As the overall riskiness of subprime loans rose between 2001 and 2006, for a market to experience sustainable growth, the subprime markup should have risen as well. We proved that this was not the case: Both the price of risk and the price per unit of risk (the subprime markup adjusted for differences in borrower and loan characteristics) declined over time. This seems to support the argument that buyers of private-label MBS were priming the pump, willing to ignore the mounting risk to satisfy their hunger for higher yields. With the benefit of hindsight, we now know that indeed this situation was not sustainable, and the subprime mortgage market experienced a severe crisis in 2007.

he combination of a large increase in credit availability, easier financing (that is, loosening underwriting standards in terms of, for instance, LTV requirements), lowering price, and deteriorating loan performance resembles a classic lending boom-bust scenario in which unsustainable growth lead to the collapse of the market. Argentina in 1980, Chile in 1982, Sweden, Norway, and Finland in 1992, Mexico in 1993, and Thailand, Indonesia, and Korea in 1997 have all experienced lending boom-bust scenarios, albeit in different economic settings. he combination of a large increase in credit availability, easier financing (that is, loosening underwriting standards in terms of, for instance, LTV requirements), lowering price, and deteriorating loan performance resembles a classic lending boom-bust scenario in which unsustainable growth lead to the collapse of the market. Argentina in 1980, Chile in 1982, Sweden, Norway, and Finland in 1992, Mexico in 1993, and Thailand, Indonesia, and Korea in 1997 have all experienced lending boom-bust scenarios, albeit in different economic settings.

Were problems in the subprime mortgage market imminent long before the actual crisis showed signs in 2007? Our answer is yes, at least by the end of 2005. By excluding the data for 2006 from our analysis, we showed that the steady degradation of the subprime market was already clear, with the worsening of loan quality already in progress for five consecutive years. The main challenge in detecting this deterioration was the steep appreciation in housing prices that masked the true riskiness of the subprime mortgage loans.

YULIYA DEMYANYK is an economist in Banking Supervision and Regulation of the Federal Reserve Bank of St. Louis, and OTTO VAN HEMERT is assistant professor of finance at NYU Stern.

The views expressed are those of the authors and do not necessarily reflect the official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Professor Van Hemert has presented this research to the US Securities and Exchange Commission, the Board of Governors of the US Federal Reserve System, and the International Monetary Fund. The paper can be downloaded in its entirety at http://ssrn.com/abstract=1020396.

|

![]()