Experts Convene at NYU Stern to Discuss Restoring Confidence in

the Credit Markets

(From left to right, top row) Dean Thomas F. Cooley, Robert Litterman,

David Backus, (bottom row) Lionel Barber, Nouriel Roubini,

and Robert Lucas suggested ways to restore confidence in the

US economy.

|

Last spring, with housing prices plummeting, oil climbing toward

$120 a barrel, and the global financial system in shambles, industry,

media, and academic leaders convened at an NYU Stern breakfast forum

to discuss how to restore confidence in credit markets and the economy.

The event was part of Stern's Market Pulse Series, introduced by

Dean Thomas F. Cooley to tackle pressing global issues affecting

business and society. The event, "Economic Meltdown: Restoring Confidence

in Credit Markets," was co-presented by Stern's Alumni Council Finance

Committee and the Salomon Center for Research in Financial Institutions

and Markets and attended by alumni, students, and the press.

Moderated by David Backus, Stern's Heinz Riehl Professor of International

Economics and Finance, the panel included Lionel Barber, editor of

the Financial Times; Robert Litterman, chairman of the Quantitative

Investment Strategies group of Goldman Sachs Asset Management; Nobel

Laureate Robert E. Lucas Jr., an economist at University of Chicago;

and Nouriel Roubini, Stern professor of economics and international

business.

Litterman noted that financial models are showing a relatively short

recession with a strong recovery at the end of 2008 but warned that

the current spike in inflation could easily lead to a prolonged inflationary

period, as it did in the 1970s.

Barber suggested that the scale of the crisis represents excessive

risk-taking, causing a crisis of valuation that warrants a re-examination

of the US's regulatory framework. However, he cautioned against adopting

the British model of "financial super-regulator," reminding the audience

that the British Financial Services Authority failed dismally with

its first stress test, Northern Rock. Without a mandate for intervention,

he said, the Bank of England wasn't in a position to take the reins.

According to Lucas, the Federal Reserve's dramatic rate cuts mark

an overreaction and conflict with Chairman Bernanke's earlier promised

inflation-targeting strategy. He felt that one of the most serious

issues is that we take for granted that it's the Fed's job to resolve

the issues of the financial system. He is concerned about introducing

new regulations designed to solve old problems.

Roubini predicted a long, deep U-shaped recession as a result of

what he labeled a systemic financial crisis, involving the worst

housing recession since the Great Depression, credit losses that

could top $1 trillion, record oil prices, a credit crunch, and plummeting

consumer confidence. The key lesson, he said, is that non-banks are

subject to the same risks as banks and are systemically important,

suggesting the need for similar regulatory oversight.

Dean Thomas F. Cooley (left) and William R. Berkley (right) honor

John Snow with the 2008 Charles Waldo Haskins Award at a celebratory

dinner in April.

Dean Thomas F. Cooley (left) and William R. Berkley (right) honor

John Snow with the 2008 Charles Waldo Haskins Award at a celebratory

dinner in April. |

NYU Stern Honors John Snow and

Celebrates

Donors at the 2008 Haskins Dinner

On April 1, NYU Stern alumni and friends gathered for the 2008 Haskins

Award Dinner at New York's Plaza Hotel. The gathering, which included

Stern's most dedicated and generous alumni, faculty, and friends,

celebrated a record $180 million raised over the last five years

during the Campaign for NYU Stern, surpassing its goal by $30 million

at the time.

At this event each year, the School bestows the Charles Waldo Haskins

Award on an outstanding individual whose career has been characterized

by the highest level of achievement in business and public service.

This year's recipient was the Honorable John W. Snow, chairman, Cerberus

Capital Management LP, and former US Treasury Secretary. In his acceptance

speech, Snow provided a lively and optimistic perspective on the

current economic situation, which he deemed in a healthy process

of readjustment. "America will get out of this," he asserted. "We

always do."

William R. Berkley (BS '66), chairman of the NYU Stern Board of Overseers,

spoke of the importance of providing stability in uncertain times

through education — which he called the great equalizer and builder

of dreams. In such times, he urged, it's more important than ever

to provide a strong education to future generations.

Ed Barr (BS '57), chairman of Stern's Campaign Steering Committee,

noted that while Campaign donors comprised a cadre of long-term supporters,

many new donors emerged in the last five years. He also talked about

the 40 new research, community-building, and curricular initiatives

the School launched through the support of the Campaign.

Rebecca Cohl, a second-year MBA student and recipient of the Harvey

Becker Scholarship with a Moral Contract, announced that 125 new

scholarships were made possible by the generous support of donors

over the last five years. Adam Brandenberger, J.P. Valles Professor

of Business Economics and Strategy, underlined the importance of

creating the right environment for ideas to flourish and told donors

they had funded 23 professorships and 10 faculty fellowships. Sally

Blount-Lyon, vice dean and dean of the Undergraduate College, thanked

donors for the more than 40 generous gifts that will help transform

Stern's physical environment. Finally, Carl Greene (MBA '60) announced

a 150 percent increase in Stern Fund dollars, describing these as

the School's lifeblood. The Campaign closed in August with a total

of $185 million, but there remain new opportunities to give back

to Stern as the need for gifts continues.

Chief Economist of the Asian Development Bank Speaks at Japan-US

Center

Dr. Ifzal Ali, chief economist for the Asian Development Bank, presented

the Bank's 2007 annual report on the economic health of Asian nations

to Stern students and faculty at an NYU Stern Japan-US Center event

held in early April.

Introduced by Edward Lincoln, director, Center for Japan-US Business

and Economic Studies, Ali discussed the surging growth of several

Asian economies. China led the group with the highest growth in 13

years, at 11.4 percent. The Philippines grew at 7.3 percent, a 30-year

high, while India grew at 8.7 percent, marginally lower than the

previous year. Ali predicted that the current economic slowdown in

the US, Europe, and Japan, rising energy and food prices, and the

credit crisis in the global markets would slow but not stop growth

in 2008. He also predicted that inflation will reach decade-long

highs in Asia this year.

New Directions in a Credit Crisis

Environment:

The Fifth Annual Credit Risk Conference

(Above, from left to right) Matthew Richardson,

Stephen Figlewski, Edward Altman, and Raymond McDaniel (right)

discussed the current credit crisis and recent advances in

risk managment at the annual Credit Risk Conference held at

NYU Stern in May. |

|

NYU Stern's Salomon Center and Moody's Corporation convened leading

academics and industry practitioners in May to discuss recent advances

in risk management within the context of lessons learned from the

credit crisis.

Matthew Richardson, Charles Simon Professor of Applied Financial

Economics and Sidney Homer Director of the Salomon Center at Stern,

introduced Moody's Chairman and CEO Raymond McDaniel, who cited the

multiple factors that contributed to the credit crisis, including

rising leverage, the overextension of housing credit, the deterioration

of underlying assets and due diligence, and the complexity and opacity

of products, which, combined, led to a loss of confidence in the

markets. McDaniel acknowledged that, in the absence of asset transparency,

the role of the ratings agencies had shifted from that of an information

intermediary between lenders and borrowers to an incentive intermediary

that markets relied on too much for recommendations. With this in

mind, McDaniel argued for more availability of information in the

public domain so that the opportunity for greater independent analysis

is widely available.

Stern Professor of Finance Stephen Figlewski presented new research

that explained the effect on credit risk of macroeconomic conditions

such as inflation and real GDP, as well as economic growth and financial

market conditions. He based his conclusions, in part, on an analysis

of defaults and ratings change data in Moody's Corporate Bond Default

Database between 1981 and 2002.

Edward Altman, Max L. Heine Professor of Finance at Stern, discussed

his research on the impact of credit markets on the overall economy,

noting that when default is high, recovery rates — which he defined

as the average price of bonds following a default — are low. He predicted

that recovery rates will fall dramatically from the past few years.

(From left to right) Joseph S. Tracey; William T. Allen; Doug Conant, president and CEO of Campbell's Soup Co.;

Richard J. Kogan, retired president and CEO of Schering-Plough Co.; and Reuben Mark

Sixth Annual NYU Directors' Institute Focuses on Boards during Uncertain

Times

The NYU Pollack Center for Law & Business,

a joint initiative between NYU Stern and NYU School of Law, in

May hosted its sixth annual Directors' Institute, "Service in the

Boardroom during Uncertain Times." Panelists represented the US

Securities and Exchange Commission, the Delaware Court of Chancery,

and the NYU Pollack Center for Law and Business, as well as directors

of Goldman Sachs Group Inc., Campbell Soup Co., and Schering-Plough

Co.

Joseph S. Tracy, executive vice president

and director of research at the Federal Reserve Bank of New York,

discussing the economy, predicted a relatively short and shallow

downturn due to aggressive policy response. Reuben Mark, chairman

of Colgate-Palmolive Co., the keynote speaker, described the strong

relationship between corporate culture and governance at Colgate-Palmolive.

William T. Allen, director of the NYU Pollack Center and Nusbaum

Professor of Law and Business, endorsed the legitimacy and importance

of the poison pill strategy in defending against hostile takeovers

and suggested that boards not preclude it from their arsenal, despite

objections from institutional shareholders. Martin Lipton, senior

partner at Wachtell, Lipton, Rosen & Katz and chairman of the

NYU Board of Trustees, discussed corporate governance, and Krishna

G. Palepu, Ross Graham Walker Professor of Business Administration

at Harvard Business School, emphasized that strategy was a useful

framework for all board responsibilities.

Amazon.com CEO Jeffrey Bezos Shares

His Business Strategy with Stern

Alumni and Students

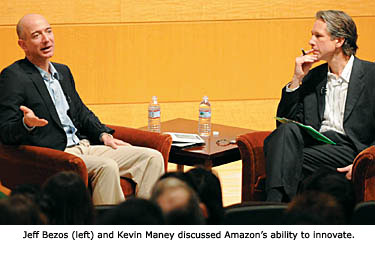

In April, in partnership with Condé Nast Portfolio, NYU Stern hosted

the magazine's signature interview series, C-Circuit, which brought

Kevin Maney, contributing editor, and Jeffrey Bezos, CEO of Amazon.com,

together on campus to speak to alumni, students, and guests. A self-described

"change junkie," Bezos explained that having investors who focus

on the long term has enabled Amazon to pioneer controversial products

and strategies. |

Nathan Myhrvold highlighted the emergence and influence of long-term exponential industries during his keynote address at the NET Institute Conference in April.

|

NYU Stern's NET Institute Conference Explores the "Exponential Economy"

In April, the Networks, Electronic Commerce, and Telecommunications

(NET) Institute and Stern's Entertainment, Media, and Technology

Program co-sponsored the NET Institute Conference at NYU Stern. The

conference featured new research on theoretical models of competition

in network markets, Internet search, and issues in network industries

presented by thought leaders from New York University, Harvard University,

London School of Economics and Political Science, Stanford University,

University of Pennsylvania, and Yale University, among others. Dean

Thomas F. Cooley kicked off the day-long event with opening remarks.

Nathan Myhrvold, founder and CEO of Intellectual Ventures, a company

focused on the funding, development, manufacturing, and marketing

of inventions, delivered the keynote speech, "The Exponential Economy."

He grouped technologies into three categories according to their

rate of growth — exponential, ordinary/logistic, and mature — and

highlighted the emergence of long-term exponential industries, such

as personal computing and communications, emphasizing their influence

in shaping the 21st-century global economy and guiding future research

and development policies.

Nicholas Economides, executive director of the NET Institute and

Stern professor of economics, commented that the conference "demonstrates

how Stern and the NET Institute encourage thought leadership and

remain on the forefront of research that influences business development

in network industries and informs today's public policy."

Philly Fed Chief Plosser Addresses Inaugural SoFiE Conference

Academics, business practitioners, and government officials convened

for the inaugural Society for Financial Econometrics (SoFiE) Conference

at NYU Stern in June to explore the ballooning field of financial

econometrics.

Sponsored by Stern's Salomon Center and Beyondbond, Inc., the three-day

event featured keynote speaker Charles I. Plosser, president and

CEO of the Federal Reserve Bank of Philadelphia, as well as leading

researchers from more than 15 universities, including NYU Stern,

MIT, Princeton University, Stanford University, University of Oxford,

and University of Pennsylvania.

"Having Philly Fed President Plosser and a number of distinguished

scholars on campus demonstrates how the Stern School and SoFiE are

leading the dialogue on financial econometrics," said Nobel Laureate

Robert Engle, SoFiE's co-president and founder and Michael Armellino

Professor of Finance at Stern. "The cutting-edge research discussed

at SoFiE's conference will inform future public policies and influence

financial markets around the world."

The World of Global Professional Services Takes the Stage at CeDER

Conference

Leading information systems academics, doctoral students, and IBM

researchers gathered at NYU Stern for the Global Delivery of Professional

Services Conference in May. Hosted by Stern's Center for Digital

Economy Research (CeDER) and sponsored by IBM, the conference featured

keynote speaker Joe Dzaluk, vice president of global infrastructure

and resource management at IBM, and seven panel discussions with

experts from more than 30 academic institutions from around the world,

including NYU Stern, HEC Montréal, MIT, and University of Texas at

Austin.

Panelists discussed risks and payoffs in outsourcing, sourcing models,

enabling agility in sourcing, sharing knowledge for innovation, and

the IT workforce. They compared the performance of globally distributed

teams to collocated teams, discussed the impact a large number of

vendors might have on innovation in knowledge-intensive activities,

and described when to open a wholly owned subsidiary offshore. IBM's

Dzaluk focused on the computer giant's operations in India, which,

with an integrated workforce of 73,000, is its second largest hub

worldwide, and the opportunities and challenges awaiting the company

in China.

One session focused on MBA courses on global sourcing — an area where

NYU Stern leads. Said Stern Professor Natalia Levina, conference

organizer and global sourcing expert: "We have been offering this

course since 2004. Given how new and critical this area is for businesses

worldwide, it is important to develop and share good teaching resources

such as cases, projects, and in-class exercises, and the conference

provided us with that opportunity."

![]()