What accounts for Europe’s and America’s different attitudes toward the free market?

By Augustin Landier, David Thesmar, and Mathias Thoenig

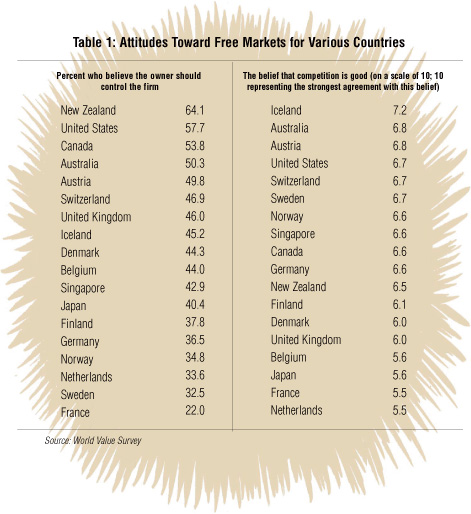

hroughout the Western world, a vast region generally viewed as dominated by capitalism, people’s attitudes toward the virtues of free markets vary widely. According to the World Value Survey, only 22 percent of French people believe that owners should run their businesses and appoint their managers, while as much as 58 percent of Americans agree with this statement, to cite one example.

hroughout the Western world, a vast region generally viewed as dominated by capitalism, people’s attitudes toward the virtues of free markets vary widely. According to the World Value Survey, only 22 percent of French people believe that owners should run their businesses and appoint their managers, while as much as 58 percent of Americans agree with this statement, to cite one example.

Academics have focused on a range of issues to explain the dispersion of pro-free market attitudes. Some argue that the uniqueness of US history – a large, ethnically heterogeneous society – has endowed modern American citizens with persistent anti-redistributive beliefs. The political economy view holds that people that gain the least from globalization are less likely to support it (for example, unskilled workers in the North, skilled workers in the South, people working in industries with high trade exposure). Still others argue that differences can be ascribed to cultural factors such as patriotism, neighborhood attachment, or a strong sense of identity.

We set out to understand what determines attitudes toward free markets by investigating how beliefs about the market economy vary across individuals, time, and countries. We constructed a dataset based on economic data like pension funding and stock market participation, and on opinion surveys, like the World Value Survey (WVS), which collects data on age, gender, and income, and measures attitudes toward economics, marriage, and religion across dozens of countries; and the Internal Social Survey Program (ISSP), whose 1996 wave contained questions on ethnicity, private property, and attitudes on state interference with free competition. By running regression analysis on this data, we were able to investigate the influence of certain factors in accounting for the differential attitudes.

We set out to understand what determines attitudes toward free markets by investigating how beliefs about the market economy vary across individuals, time, and countries. We constructed a dataset based on economic data like pension funding and stock market participation, and on opinion surveys, like the World Value Survey (WVS), which collects data on age, gender, and income, and measures attitudes toward economics, marriage, and religion across dozens of countries; and the Internal Social Survey Program (ISSP), whose 1996 wave contained questions on ethnicity, private property, and attitudes on state interference with free competition. By running regression analysis on this data, we were able to investigate the influence of certain factors in accounting for the differential attitudes.

Our analysis of the WVS focused on the answers given to questions about (1) the benefits/harms done by competition; (2) whether owners, employees, or the state should run the firms; (3) the merits of private ownership of business and industry; and (4) the trustworthiness of large firms. The data show a large variation in cross-country attitudes toward free markets. Two examples are given in Table 1, which focuses on the 18 richest countries in our sample and displays mean variables for all three waves of the WVS.

In the cross section of countries, preference for redistribution and attitudes toward free markets showed little, if any correlation. But this was less true at the individual level. People that tended to favor income equality also tended to distrust competition, large companies, and shareholder control of firms. In order to isolate the pure effect of “pro-free market” beliefs, we used as control variables attitudes such as: trust (many existing studies have shown that trust explains well the cross section of various economic outcomes, such as GDP growth); aversion to inequality (defiance toward free markets may stem from a concern for equality); pro-trade (in many instances, defiance toward market forces can be defiance toward globalization); and religion (academic work has shown, in general, that being religious is positively correlated with a positive perception of work and thrift). When we ran the data, we found that the unconditional correlations were not very high, which suggests that individual determinants of opinions are very diverse across attitudes. And yet we found that all four “market” variables are positively correlated with each other. Pro-competitive people also tend to support less equality, seem to favor free trade, and tend to be less religious and less confident in other people, for example.

Self-Interest

Why do attitudes toward free markets vary so much across individuals?

The political economy view holds that self-interested individuals

hold the beliefs that suit them best. In the developed

world, for example, those least supportive of free trade

also tend to have lower levels of education or work in

industries where foreign competition is high. To test this

hypothesis, we explored responses on two broad and distinct

sets of issues: attitudes toward competition and attitudes

toward the profit-motive. Attitudes toward ownership and

competition shared some common determinants that proved

to be statistically significant. Support for competition

and owner control was also more prevalent among older people.

(One possible explanation is that older people, being closer

to retirement or more entrenched in their jobs, are more

sheltered from the shocks of competition.) People with

higher levels of income also showed strong support for

market forces and self-interested behavior. Our preferred

interpretation of this finding is that income is a proxy

for the ratio of financial wealth to human capital. Another

possibility is that income is a proxy for skill. Skilled

labor is more protected from off-shoring and creative destruction

that accompany for-profit management and tougher competition.

“French legal origin was strongly related to competition aversion, and British common law was related to a strong preference for owner control. These findings suggest that long-run institutional determinants rooted in the history and culture of a country dominate more recent developments in the organization of its economy.” |

A more powerful test of the political economy view consists in combining the individual characteristics with country-level institutional features. We did so by looking at the cross-country dispersion in pension funding and financial development as a measure of the extent of financial markets institutions and compared how young and old people answered the questions. In theory, older people, who control a greater chunk of financial wealth, should display more free-market support in countries where they are the most likely to hold a larger fraction of financial wealth. Generally speaking, we found that in countries where pensions are funded, in financially developed countries, the old are much more likely to be supporters of the free market than the young. The probability that the young favor owner control was larger by 18 percentage points in the pension-funded countries. The probability that older citizens do so is larger by 30 percentage points.

It’s natural to wonder whether the institutional determinants that impact the support for markets come from very far in the past or are largely driven by recent developments. Several scholars have argued that in a cross-section of countries, distant legal origins matter. Compared with countries whose systems derive from French civic law, countries whose systems derive from British common law have a stronger propensity to protect debtholders and shareholders, have lower job protection, and facilitate entry by making business creation easier. When we ran the numbers, we found that legal origin has a significant impact. Notably, French legal origin was strongly related to competition aversion, and British common law was related to a strong preference for owner control. These findings suggest that long-run institutional determinants rooted in the history and culture of a country dominate more recent developments in the organization of its economy.

There’s more evidence that culture matters. Consider that only about 48 percent of American households own stocks directly or indirectly. This makes it unlikely that the median voter will support owner control or free competition just because it boosts the return of its portfolio. And yet, 57 percent of US respondents agreed with the statement that the “owners should appoint the management,” and more than 70 percent of US respondents who work for others agree with the proposition that “management should only care about profits.” The diffusion of equity ownership in the US cannot alone explain why American citizens support free markets more than do citizens of other countries.

Culture may be a factor in explaining such results. Scholars have argued that attitudes are affected by ethnic origins because they have a cultural component, and that culture is transmitted within the family. To test this hypothesis, we constructed two indices of cultural proximity to seven major western cultures: France, Germany, Russia, Spain, Sweden, the UK, and the US. The first index measures proximity to economic culture using as controls an aversion to inequality and a pro-trade attitude. The second index of cultural proximity is related to non-economic values, such as religious proximity. We also looked at whether each country has been, at some point in history, a colony of one of the seven countries we mentioned above. Our tests showed that cultural proximity to French economic attitudes predicts a significantly lower support for owner control, as does proximity to Germanic and Nordic economic attitudes. Proximity to British attitudes does, however, predict a higher-than-average propensity to favor owner control. Countries with British legal origins and/or who have been, at some point, colonized by the British tend to display a higher degree of ownership control. Meanwhile, countries that had been colonized by Spain and Russia are systematically less supportive of competition, while former Swedish and British colonies are more pro-competitive.

Generational Difference

For country differences in beliefs about markets to be permanent and unexplained by self-serving behavior, divergent beliefs of individuals need to persist throughout generations. But we also know that ideas and attitudes change over time. We tried to get at this issue by focusing on former communist countries and comparing attitudes toward free markets held by younger generations to attitudes of generations that were already adults when the Berlin Wall fell. We found that in the West, younger generations tend to be less pro-market in general. For people born after 1970, the probability of supporting owner control or competition was lower by 1 percentage point. The probability of supporting state ownership over private ownership was higher by 5 percent, a much larger difference. But the generational divide was significantly larger in post-communist countries than in other countries. In former communist countries, the young are 7 percentage points more likely to support the for-profit motive, 9 percentage points more likely to support private ownership over state ownership, but only 2 percentage points more likely to support competition. These findings suggest that the forces that shape the preference for redistribution are not necessarily the same as those which shape attitudes toward market forces. Clearly, past shocks and shared experiences shape generation/population-wide attitudes.

o investigate

further how fast beliefs can adapt from one generation to the next if the economic

context changes, we looked at evidence from immigrants. For our purposes, we

grouped country/language/ethnicity of origin into four broad categories: English-speaking

countries, Continental Europe, Eastern Europe, and Nordic countries. The regressions

we ran broadly confirm the results obtained on individual and country data.

Respondents from English-speaking countries show consistently more support

for both free markets and private property. Respondents of Eastern European

origin show the strongest support for state ownership and an activist industrial

policy.

o investigate

further how fast beliefs can adapt from one generation to the next if the economic

context changes, we looked at evidence from immigrants. For our purposes, we

grouped country/language/ethnicity of origin into four broad categories: English-speaking

countries, Continental Europe, Eastern Europe, and Nordic countries. The regressions

we ran broadly confirm the results obtained on individual and country data.

Respondents from English-speaking countries show consistently more support

for both free markets and private property. Respondents of Eastern European

origin show the strongest support for state ownership and an activist industrial

policy.

We ran the same regressions focusing

on US residents. The focus on the US is useful because it is

the country where regions of origin are the most diverse. Here,

we found mixed evidence that indeed, free market attitudes

are strongly transmitted within the family and are weakly dependent

of the economic context. For instance, respondents of Eastern

Europe origin were 22 percent more likely to support redistribution;

US residents of such origin were 6 percent less likely – not

statistically significant – to do so. In general, the

difference in attitudes between US citizens of Anglo-Saxon

descent and other origins was both small and insignificant

statistically, while the difference was strong on the worldwide

sample. This suggests that such beliefs are much more conditioned

by environmental characteristics than by transmission of family

values.

What should we conclude from

this investigation? First, we find that the traditional political

view according to which individuals hold political opinions

that are self-serving is consistent with the data. In general,

individuals that would benefit more from a pro-market agenda

exhibit stronger pro-market opinions. But this tendency alone

can’t explain the sometimes significant differences between

countries. The attitudes of a country toward markets are slow-varying

and seem, on aggregate, to be strongly determined by historical

and cultural factors. When it comes to explaining differences

between countries’ views toward fundamental issues of

markets and competition, economic theory matters. But so, too,

do other factors, such as culture, legal systems, ethnicity,

and family, matter.

Augustin Landier is assistant professor of finance at NYU Stern, David Thesmar is professor of economics at the Ecole Nationale de la Statistique et de l’Administration Economique (ENSAE) in Paris, and Mathias Thoenig is professor of economics at the University of Geneva.

![]()